We build products to advance sustainable investing.

We pull together experts to build products with strong empirical foundations in academic research.

Vert Global Sustainable Real Estate ETF

We designed the Vert Global Sustainable Real Estate ETF

to make it easy for investors to move their money toward sustainability. The ETF offers:

- Consistent exposure to sustainable real estate companies

- Evidence based Environmental, Social, and Governance criteria

- Broad diversification across countries and property sectors

- Active shareholder engagement

Vert's Partnership Model

We partner with leading providers to build robust investment portfolios.

Fund Providers

Scale and efficiency for Custody, Accounting, Administration & Transfer Agency

Portfolio Managers

Decades of experience and 24 hour trading capabilities across all global regions

Academics

Original thought leadership and ongoing empirical research

Our Philosophy

We believe there is economic value in sustainability. We maintain that companies focused on the triple bottom line of people, planet and profits will be better positioned for the risks and opportunities of the future than those focused on profits alone. We believe in a long term perspective. Companies that look further out than the quarterly reporting cycle can invest in more projects that build value for the firm over time.

We believe that markets work well, and price available information. More information, including environmental, social, and governance factors, can make markets work better. We build portfolios of companies that use sustainability to drive value, take a long term perspective and are open and transparent.

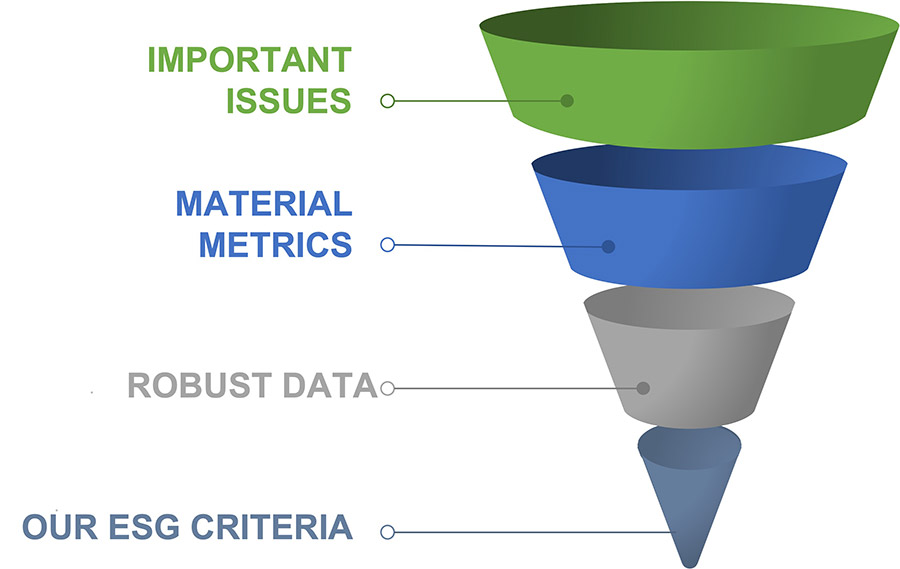

Our Sustainability Research Process

We continuously search for the most important ISSUES for people and planet, and then use empirical research to narrow them down to the METRICS with the most material impact. We then only use metrics we can source robust DATA on. The final list are our ESG CRITERIA.